By mid-August 2025, the UK’s internet landscape has hit new highs; nearly 80% of homes can now access full-fibre broadband, and roughly 88% are covered by a gigabit-capable connection^[1]. This rapid rollout means faster speeds and more choice for you, but it also raises new questions. Are consumers keeping up with the pace of change? What does the rush of new fibre providers mean for prices and service? And how can you take advantage of the latest deals while avoiding pitfalls? In this update, we’ll break down the key developments in the UK broadband market as of August 2025; from record network expansion and alt-net shake-ups to new rules that could affect your monthly bill. By the end, you’ll know exactly what’s happening and how to make it work for you.

UK Full-Fibre Rollout: On the Home Stretch: It’s official: 2025 is the year full-fibre went mainstream. Over 20 million premises are now passed by fibre-to-the-premises (FTTP) lines, up from virtually zero just a few years ago. That’s about 79% of UK homes reached, a huge jump from 57% in late 2023 (ofcom.org.uk). Industry leader Openreach (BT’s network arm) alone has built out fibre to 19 million properties so far, putting it on track to hit 25 million by end of 2026^[2]. And it’s not just about quantity, quality is rising too. Openreach and others are deploying the latest tech like XGS-PON (capable of 10 Gbps shared capacity) so they can offer multi-gigabit packages in select areas. Meanwhile Virgin Media O2, which uses cable for most of its network, is upgrading to full fibre and testing DOCSIS 4.0 to boost cable speeds.

- Alt-Nets Fuel Local Fibre: Beyond the big players, dozens of smaller alternative network providers (alt-nets) are fiberising (if thats a word) towns and villages across the country. Collectively, these alt-nets now cover over one-third of UK premises (around 15.2 million homes)^[3], often focusing on areas the majors overlooked. They’ve been especially crucial in rural regions; nearly a third of the UK’s most remote premises can finally get full-fibre thanks to alt-net builds. Companies like CityFibre, Hyperoptic, Community Fibre, Gigaclear, Netomnia, Zzoomm and others are competing to wire up cities and shires alike. For example, CityFibre alone passes over 4 million premises and has recently upgraded 85% of its network to XGS-PON for multi-gig speeds. Netomnia has reached about 2.5 million premises and counting, while newcomer nexfibre (the joint venture with Virgin Media O2) has cleared the 2 million mark and aims for 5 million by 2026. Alt-nets are raising serious money to do this; CityFibre sealed a £2.3 billion investment deal in July to fuel further expansion, and others like Grain Connect have pulled in hundreds of millions for their regional builds. The result? Many UK neighborhoods now have not just one but three fibre networks vying for customers (Openreach, Virgin, and an alt-net), which is a far cry from the old days of one slow copper line.

- Consolidation and Competition: The flip side of the alt-net boom is that not all of these newcomers will survive long term. Building fibre is expensive, and with over 100 alt-net firms in the market, a shake-out is underway. In fact, 96% of alt-net providers say they’re considering mergers or partnerships to stay competitive^[4]. Industry analysts predict that in a few years we may go from a patchwork of tiny fibre companies to just a handful of large nationwide players. We’re already seeing the early signs: recently CityFibre acquired Lit Fibre’s network, and regional providers FullFibre and Zzoomm agreed to merge, combining their resources to cover around 600,000 premises^[5]. These kinds of tie-ups are likely to continue as investors push for scale. For consumers, consolidation could have a mixed impact. On one hand, a stronger alt-net (through mergers) might be able to serve more areas and compete better with BT or Virgin on price. On the other hand, less competition in a given town could mean fewer choices. For now, though, the price pressure is on with so many operators in the game, broadband deals in many regions have never been cheaper (more on that shortly 😉).

Bridging the Gap: Availability vs. Adoption – All this infrastructure is transformative, but only if people use it. Surprisingly, millions of households haven’t yet upgraded to the faster services now available. Where full-fibre is offered, only about 35% of homes on average have taken it up so far^[6]. That’s an improvement from ~28% a year earlier, but it means nearly two-thirds of eligible households are still on older connections. The disparity between regions is striking: in rural areas, over 50% of homes with access to fibre have made the jump (after waiting years for better broadband, they’re seizing the opportunity). In towns and cities, though, uptake is around 32% – barely one in three urban homes with fibre available are subscribing so far^[6]. Why the hesitation? Often it’s down to awareness and inertia. If you already get, say, 50 Mbps on an older fibre-to-the-cabinet (FTTC) or cable plan, you might feel that’s “good enough” and not realise a gigabit service could be just a few pounds more. Many people also stick with what they know; switching providers or plans can seem daunting if you’ve had the same one for years.

This adoption lag has big implications. For network builders, low uptake can threaten the business case for further expansion; an alt-net that has laid fibre on your street really needs customers to sign up, or they might not recoup their costs. For consumers, it means a lot of folks are effectively leaving speed (and possibly money) on the table. If you’re still on a legacy copper line or an older package, it’s worth checking what’s now available. In many areas, gigabit packages (1000 Mbps) are being sold at prices similar to what 50–70 Mbps plans cost a few years ago. Picture this: you could potentially jump from a patchy 40 Mbps ADSL or FTTC connection to a 150 Mbps or 500 Mbps full-fibre connection and save money, simply by switching to a new provider. Don’t assume your current deal is the best value – the market is changing too fast. (We’ll show you how to audit your own setup in a bit with a quick checklist.)

Copper’s Last Stand: The Big Switch-Off: Amid the fibre frenzy, the old copper telephone network that served Britain for decades is being gradually retired. If you still have a traditional landline or an ADSL broadband service, changes are coming. In August 2025, Openreach added 137 more exchange areas to its “Stop Sell” list, which means in those locations you generally can’t order new copper-based services (or make major plan changes) once fibre coverage hits 75% of premises. This is part of an ongoing program, exchange by exchange, copper lines are being frozen out as fibre becomes dominant. Nationwide, tens of millions of copper lines will be phased out over the next two years. BT’s timeline for the full copper switch-off (including the old analog phone system, the PSTN) is set for 31 January 2027, a slight push from the original 2025 goal. That gives consumers and businesses a bit more breathing room, but the direction is clear: copper is on borrowed time.

For consumers, the key takeaway is to plan ahead. If your home is still on an ADSL or FTTC connection and full-fibre is now available, don’t wait until the last minute when copper service might be withdrawn. Making the switch on your own terms means you can shop around for the best deal, rather than being forced onto whatever your provider offers later. Not to mention, you’ll likely enjoy a big boost in reliability and speed by moving to fibre. The shift also affects voice calls as landline phones are transitioning to Voice over IP (digital voice via your broadband router). The good news is most providers supply the necessary adapters or new handsets to make this easy. And if fibre hasn’t reached you yet (perhaps you’re among the tiny fraction – 0.2% of UK premises – still stuck under the USO “decent” speed of 10 Mbps, solutions like 4G/5G broadband or satellite are increasingly viable stop-gaps. Projects under the government’s Project Gigabit are also ongoing to fund fibre builds in the hardest-to-reach areas – over 113,000 rural homes have been connected via these schemes so far (38% higher than last year) as state-subsidised contracts start to bear fruit. So, even in the remotest parts of the UK, options for a decent connection are steadily improving.

New Rules to Protect Your Pocket: Broadband bills have been a sore point for many, especially after several providers hiked prices earlier in 2023. But here’s some relief: Ofcom banned inflation-linked mid-contract price rises effective 17 January 2025^[7]. This means no more mysterious “CPI + 3.9%” clauses that let providers jack up your price each year by an unpredictable amount. Any price increase now has to be a fixed, transparent figure stated upfront in your contract. For example, a plan might clearly say “price will rise by £2 per month in month 13” and if it doesn’t say that, the price should remain the same throughout your minimum term. This rule change came after Ofcom found most consumers didn’t understand those inflation-based terms (hardly a surprise, as even experts can’t predict inflation two years out). The ban applies to new contracts from 2025 onwards, so it won’t stop any increases built into deals you signed before that date. However, all major ISPs have had to revamp their pricing models going forward. Some, like Hyperoptic and Cuckoo, proudly advertise no mid-contract rises at all. Others, like BT and Three, now use fixed-sum rises (e.g. a £2 or £3 bump after 12 or 24 months). The idea is to give you more certainty and allow easier comparisons when shopping around – you can actually compare pounds and pence rather than puzzling over who uses CPI vs. RPI + X%.

Speaking of comparing deals, Ofcom and the Advertising Standards Authority (ASA) have also cracked down on how providers must advertise their prices. Any in-contract increases have to be made clear in ads and at point of sale (not buried in small print). So when you’re browsing offers, look for those notes about future prices, they should be obvious now. If you’re fed up with price hikes, remember you always have the option to switch at the end of your contract (or even mid-contract without penalty if a provider breaks the agreed terms with a hike that wasn’t properly disclosed, or advertised speeds that aren’t being delivered). In fact, our site has a dedicated guide on how to Beat mid-contract broadband price hikes – keep your bill under control if you want to explore strategies like haggling or moving to a fixed-price provider.

Quicker Complaints & Easier Switching: In another win for customers, the telecom regulator is making it faster to get help if things go wrong. Starting April 2026, you won’t have to wait a full 8 weeks of unresolved wrangling with your ISP before escalating a complaint. The waiting period is being cut down to 6 weeks^[8]. After six weeks of no resolution, you can take your issue to an independent ombudsman service (for free) to seek a fair outcome. This reduces the limbo time by a fortnight, which can feel like ages when your internet is down or a billing dispute is dragging on. The change might seem small, but it’s part of ensuring providers address problems promptly rather than stringing unhappy customers along.

Perhaps the biggest quality-of-life improvement for consumers in the past year has been the introduction of One-Touch Switch (OTS) for broadband. If you haven’t switched providers recently, you’ll be glad to know it’s no longer a headache of canceling with one company before starting another. Under the new system; launched in Sept 2024, you just contact the new provider you want, and they handle the switch-over process with your old provider. Over 1.1 million UK customers have already switched their broadband this way in the past 11 months^[9]. It’s a gaining provider-led process, meaning the company you’re moving to has every incentive to make it smooth and quick for you. For most switchers, downtime is minimal (often just a few minutes on switchover day) and you no longer risk being caught in a gap between services. All the major ISPs are on board with One-Touch Switch now, and the few smaller ones who lagged have mostly fallen in line after a nudge from Ofcom. Looking ahead, a similar system for business broadband switches is in the works with testing underway this year, with hopes to launch a business One-Touch scheme by early 2026. So whether you’re a household or a company, changing broadband providers is getting simpler and safer. In short, loyalty doesn’t pay in this market, if you see a better deal, you can switch with far less hassle than before.

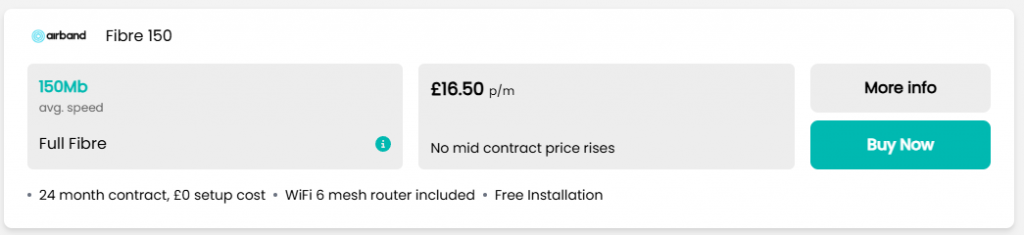

The Best Broadband Deals Right Now: With the infrastructure upgrades and new rules above, 2025’s broadband market isn’t just faster, it’s more competitive on price. ISPs are battling harder for your custom, which is great news for bargain hunters. Just this summer we’ve seen standout offers like Airband Fibre 150 at only £16.50 per month – get the deal here**. That’s a 24-month contract that gives you average speeds around 100–150 Mbps, all for a price that undercuts many other fixed-line packages.

Traditional broadband providers have responded with deep discounts of their own. It’s now common to find full-fibre 100 Mbps plans under £20, and 500 Mbps or gigabit plans for £25–£30 on promotion. For instance, at the time of writing, one major provider is offering 150 Mbps fibre for £23.99, and several smaller fibre ISPs have 1 Gbps packages in the £25–£29 range for new customers. The abundance of alt-nets plays a role here too, if you live in a town with an alternative fibre provider, you might see the big names dropping their prices to avoid losing you. According to a recent industry survey, customers of alt-net fibre ISPs report paying around £28 per month on average for 440 Mb speeds, compared to about £39 per month for ~227 Mb with the large mainstream providers^[11]. In other words, these nimble local players often deliver roughly double the speed for substantially less money. Even if an alt-net isn’t in your area, you can use that competitive pressure to your advantage by seeing if your provider will price-match or by simply switching to one of the aggressive deals out there. Don’t be shy to shop around and save – the average UK broadband shopper could save in the realm of £150-£400 off their contract by switching, based on various studies.

For families on a tight budget, Social Tariffs deserve a special mention. These are discounted broadband plans for people on certain government benefits (like Universal Credit, Pension Credit, etc.). Many providers offer them: BT, Virgin Media, Sky, Now, Vodafone, Hyperoptic, Community Fibre and others, typically priced around £12 to £20 per month for a decent speed (often 30–50 Mbps, sometimes higher). Importantly, they usually come with no contract or exit fees, so you’re not locked in if your circumstances change. Ofcom has been pushing awareness of social tariffs because surprisingly few eligible households use them. The savings can be significant: an Ofcom report noted that switching to a social tariff could cut an eligible home’s broadband costs by over £220 per year on average^[12]. Yet as of early 2023, only about 5% of households on Universal Credit had taken advantage of these offers^[13]. If you think you might qualify, it’s absolutely worth checking out – £12 a month for broadband that would normally cost £25–£30 is a real help in the cost-of-living crisis. Even students can benefit from special deals, for example, some mobile operators offer discounted SIM-only data plans that could serve as home internet in a pinch. The bottom line is, whether you’re a gigabit enthusiast or just need basic connectivity on a budget, 2025 offers more choices than ever to get a fair deal.

So, what should you do next? Below is a quick self-audit checklist to make sure you’re making the most of the current broadband market:

- Check Your Options: Availability varies by location, so start by entering your postcode on SearchSwitchSave.com or Check these broadband deals to see what’s live in your area. Don’t assume your current provider is the only choice, you might discover full-fibre from a new supplier, a faster cable package, or a strong 5G broadband offer that wasn’t there a year ago. The search will show all types: fibre, cable, and wireless, along with the speeds and latest prices.

- Compare Speed vs. Need: Once you see what’s available, think about your household’s usage. Are you working from home, doing video calls, or is your family streaming on multiple devices? If so, moving from (for example) 50 Mbps to 200+ Mbps could greatly improve your experience (no more fights over bandwidth or buffering in the middle of Netflix). On the other hand, if you mainly email and browse, a lower-tier cheap plan might suffice. Many providers offer 1-month rolling deals alongside 12- or 18-month contracts; consider whether you value flexibility or rock-bottom price. And always note the total 12-month or 24-month cost including any promo period and later price- with the new fixed-price rules, it’s easier to calculate this.

- Make the Switch and Save: Once you’ve identified a plan that offers a better bang for your buck, go for it! Initiate the switch with the new provider and let them handle the rest (remember, One-Touch Switch means you typically don’t even need to contact your old provider to cancel). Our data shows that users can save up to £390 off their contract value by switching to a new deal, those are real savings you could use elsewhere. Plus, you’ll often double or triple your speed in the process of switching, as older packages tend to cost more per megabit. It’s a win-win: more speed, fairer price. Just be sure to time your switch for the end of your current contract to avoid any exit fees (or use a deal’s upfront savings to offset them if you jump early). And don’t worry about downtime as most switches today are virtually seamless, perhaps a few minutes of outage at most during activation.

Finally, a glimpse ahead: the UK broadband market is evolving at record speed, and that momentum isn’t slowing. Full-fibre coverage is racing toward 97–98% of homes by 2027, meaning the digital divide will continue to shrink. Providers are already teasing next-gen upgrades (CityFibre even hints at 100 Gbps networks in the 2030s!). And with new players, from satellite services such as Starlink to mobile operators like three mobile, all vying for a piece of the pie, you can expect even more innovative options to stay connected. The takeaway for consumers is empowering: staying informed = staying in control. So keep an eye on our upcoming updates, and don’t hesitate to re-evaluate your broadband yearly, you could unlock much better value with just a few clicks. The future is full-fibre, fast, and consumer-friendly, and it’s coming to a street near you if it hasn’t already. Are you ready to plug in?

#SearchSwitchSave #UKBroadband #FullFibre #GigabitInternet #BroadbandDeals #FibreRollout #AltNets #BroadbandNews #ProjectGigabit #Openreach #CityFibre #VirginMediaO2 #OneTouchSwitch #CopperSwitchOff #5GBroadband #DigitalDivide #SaveOnBroadband #SocialTariff #BroadbandSwitching #UKTech #ConnectedBritain

Source links

- (thinkbroadband – UK Broadband Coverage Statistics, Aug 2025) – 79.29% of UK premises have full-fibre availability, and 88.39% have gigabit coverage as of 9 August 2025.

- (Fitch Ratings – BT Group update, July 2025) – BT’s Openreach FTTP footprint reached over 19 million premises, on track for 25 million by end-2026.

- (INCA/Point Topic report via Digit.fyi, Apr 2025) – Alt-nets saw 35% YoY growth and now reach ~15.2 million UK premises (over one-third of homes).

- (Neos Networks survey via ISPreview, May 2025) – 96% of UK alternative network providers are considering mergers, acquisitions or partnerships amid competitive and financial pressures.

- (Digit.fyi – Altnet market, Apr 2025) – Recent consolidation examples: CityFibre’s integration of Lit Fibre, and the merger of FullFibre with Zzoomm (creating a 600k premises network). Market expected to consolidate to a few major players.

- ofcom.org.uk(Ofcom Connected Nations Report Dec 2024) – Full-fibre take-up has risen to 35% of homes (7.5m out of 20.7m passed). Uptake is 52% in rural areas vs 32% in urban areas, indicating slower adoption in towns/cities.

- ofcom.org.uk(Ofcom announcement, July 2024) – New rules prohibit inflation-linked or percentage-based price rises in telecom contracts from 17 Jan 2025. Any mid-contract price increase must be a fixed amount set out in advance.

- ispreview.co.uk(ISPreview, Aug 2025) – Ofcom confirmed that from April 2026, the window for unresolved telecom complaints before escalation to ADR will be shortened from 8 weeks to 6 weeks, allowing faster dispute resolution for consumers.

- ispreview.co.uk(ISPreview, May 2025) – The industry-wide One Touch Switch system (launched Sept 2024) has facilitated over 1,000,000 broadband switches in the UK. This gaining-provider-led process simplifies switching for consumers.

- ispreview.co.uk(ISPreview, Jul 2025) – Three UK introduced a major discount on its 4G/5G home broadband, cutting the price to £17 per month on a 24‑month plan – one of the lowest prices for unlimited wireless broadband.

- (BroadbandGenie survey via Broadband.co.uk, Jul 2025) – UK alt-net broadband customers reported average download speeds of 440 Mbps for ~£28/month, compared to 227 Mbps for ~£39/month with large national ISPs – about 94% faster for 28% less cost.

- (Ofcom Annual Report 2024/25 – Section on social tariffs) – Social broadband tariffs (for eligible benefit claimants) could save households over £220 per year compared to standard tariffs.

- researchbriefings.files.parliament.uk(House of Commons Library – Telecoms briefing, Feb 2023) – As of early 2023, only ~5.1% of eligible Universal Credit households had subscribed to a social tariff for broadband or mobile, underscoring low uptake of available discounted plans.

** Subject to postcode availability.